Business transactions have evolved tremendously over the years—moving from using commodity items like silver and gold to paying with currency (cash) and now going cashless.

With solutions like QR Code payment systems, many modern customers no longer carry cash to pay for products and services. Some are adopting cashless tipping as well, moving even further away from cash-based transactions.

As cashless tipping gains traction, it’s becoming increasingly important for businesses to offer this option to enhance the customer experience. But as a business owner, you have to ask yourself whether it’s worth the investment.

This post will help you answer that question by looking at why cashless tipping is becoming popular and assessing its value in service industries.

Note: The brands and examples discussed below were found during our online research for this article.

What is cashless tipping?

Cashless tipping is a system where customers use digital payment methods (such as mobile apps, QR Codes, or digital wallets) to tip service workers. It’s becoming widely popular among businesses in the hospitality and service industries, such as restaurants, salons, and pet groomers.

Not only does it eliminate the need to handle physical cash, but it also provides a more convenient option for both customers and service providers.

Here’s how it works with the different technologies you can use:

- QR Codes: Service providers display dedicated QR Codes linked to their accounts for customers to scan. When they do, they’re directed to a landing page where they enter their preferred tip amount.

- Digital payment systems: Customers use apps like Venmo and PayPal to transfer money directly to providers’ accounts.

- Point of sale (POS) integrations: Here, service providers integrate digital tipping options into existing POS systems. This allows customers to add gratuity when paying their bills via credit card, debit card, or digital wallet.

Why cashless tipping has become so common for customers

The evolution of digital payment technology, shifts in customer preferences, and safety concerns are key drivers in the rise of cashless tipping. Here’s how these factors are helping this revolutionary system gain traction.

Digital payment convenience

The development of digital payment technology is no doubt a leading contributor to the growing adoption of cashless tipping. After all, why carry cash around when you can tip directly from your mobile device?

The convenience of mobile tipping appeals to both customers and businesses and creates a more seamless checkout process.

Increased customer satisfaction and ease

Modern customers appreciate cashless solutions. The proof is in the numbers—cash payments accounted for only 18% of transactions in 2022 as more customers embraced cashless payment options.

Cashless tipping enhances customer satisfaction by offering flexible, easy-to-use tipping options (such as QR Codes) and eliminates the need for physical currency.

Health and safety concerns

Cash is often covered in bacteria and viruses, which is why most businesses moved to cashless, contactless payments like Apple Pay and Google Pay during the pandemic.

But even though most people are no longer living under a major health threat, customers still prefer safer, low-contact cashless payments and tipping options. They reduce the need for physical cash handling and minimize the risk of germ transfer between customers and service providers.

How has cashless tipping helped service industries?

Now to the key question on every business owner’s mind: Is cashless tipping really worth it? Without a doubt! Here are some of the benefits this tipping system offers businesses.

Simple payment processing

As a service provider, you already know how tasking reconciling cash tips at the end of a shift can be. If you use a tip-share system, where tips are pooled and distributed evenly to employees, that process becomes even more time-consuming and tedious.

Cashless tipping eliminates the hassle of manual tip distribution. When customers use mobile apps, cards, digital wallets, or QR Codes for purchasing, you can process tips alongside other transactions, eliminating the need for separate cash-handling processes. This means faster transactions for customers and a lower administrative burden on your part.

You can also distribute tips electronically to employees as part of their paychecks, reducing the time spent on this task.

More accurate records for tips

Some jurisdictions, such as the U.S., have tip regulations that businesses must comply with—American employers must keep tip reports and withhold taxes if tip amounts exceed $20 per month. But maintaining compliance can be challenging with a cash-based system, as there’s no way to track how much employees earn.

That’s a big reason why some providers are turning to cashless tipping. Digital tips are automatically recorded with a business’s payment system, improving transparency and accuracy for both employees and employers. They create a clear paper trail, making it easier for employees to report tips and for employers to withhold appropriate tax amounts.

Beyond helping with compliance, cashless tipping also minimizes the risk of disputes. It allows businesses to maintain tip ledgers, which employees can review whenever they have questions about tip payouts.

Increased tip frequency or amounts

Everyone has forgotten their wallet or assumed they had enough cash to tip, only to find they didn’t. Unfortunately, this often results in leaving without tipping or giving a smaller tip than you would like.

Cashless tipping solves this problem. Since customers are no longer limited to the cash they have on hand, they can tip larger amounts and more frequently.

The convenience of it all can also encourage some customers to leave larger tips. This ultimately works in a business’s favor, since larger, more frequent tips could mean more motivation for employees.

How you can implement cashless tipping in your business

From dedicated digital tipping platforms to third-party solutions, there are plenty of ways to adopt cashless tipping in your business. Some of the most common ones include:

Use QR Codes for tipping

QR Codes are an excellent way to implement cashless tipping because they’re affordable and easy to use. All customers need to do is scan a designated code with their mobile devices to access your payment page, eliminating the need to navigate through apps.

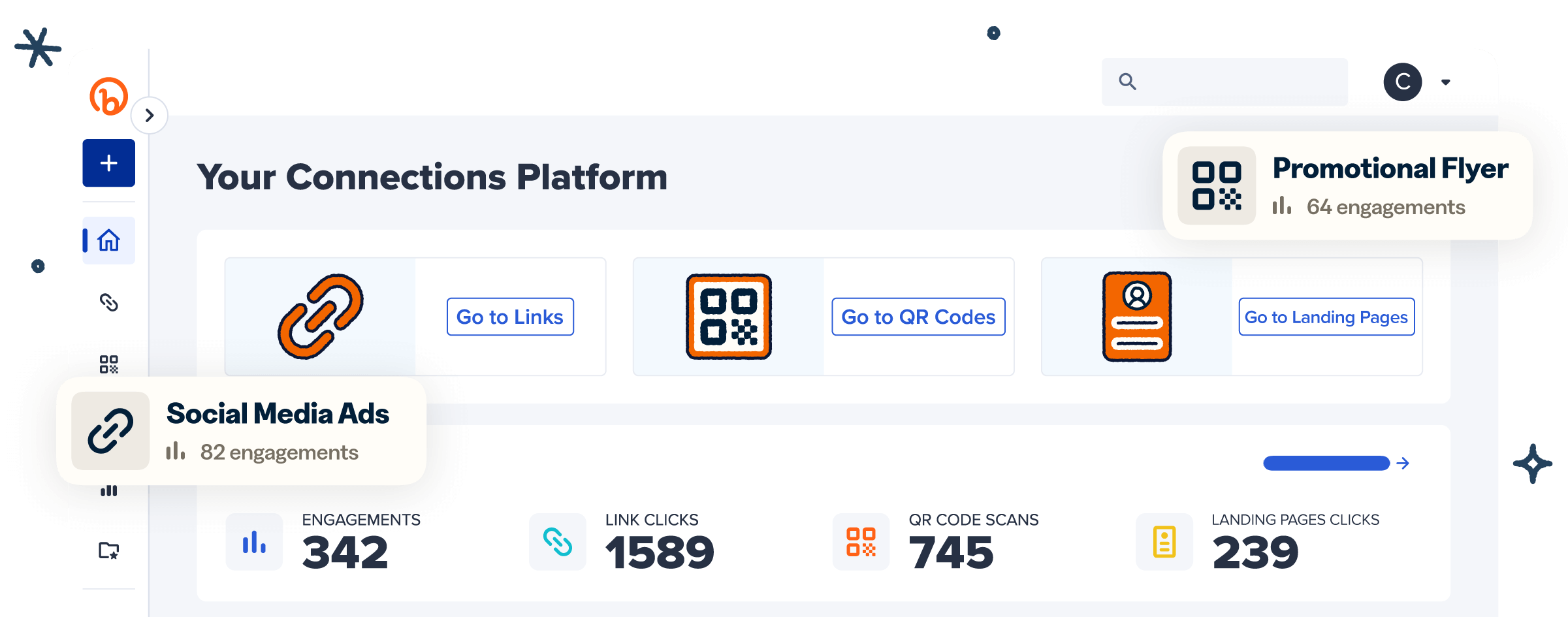

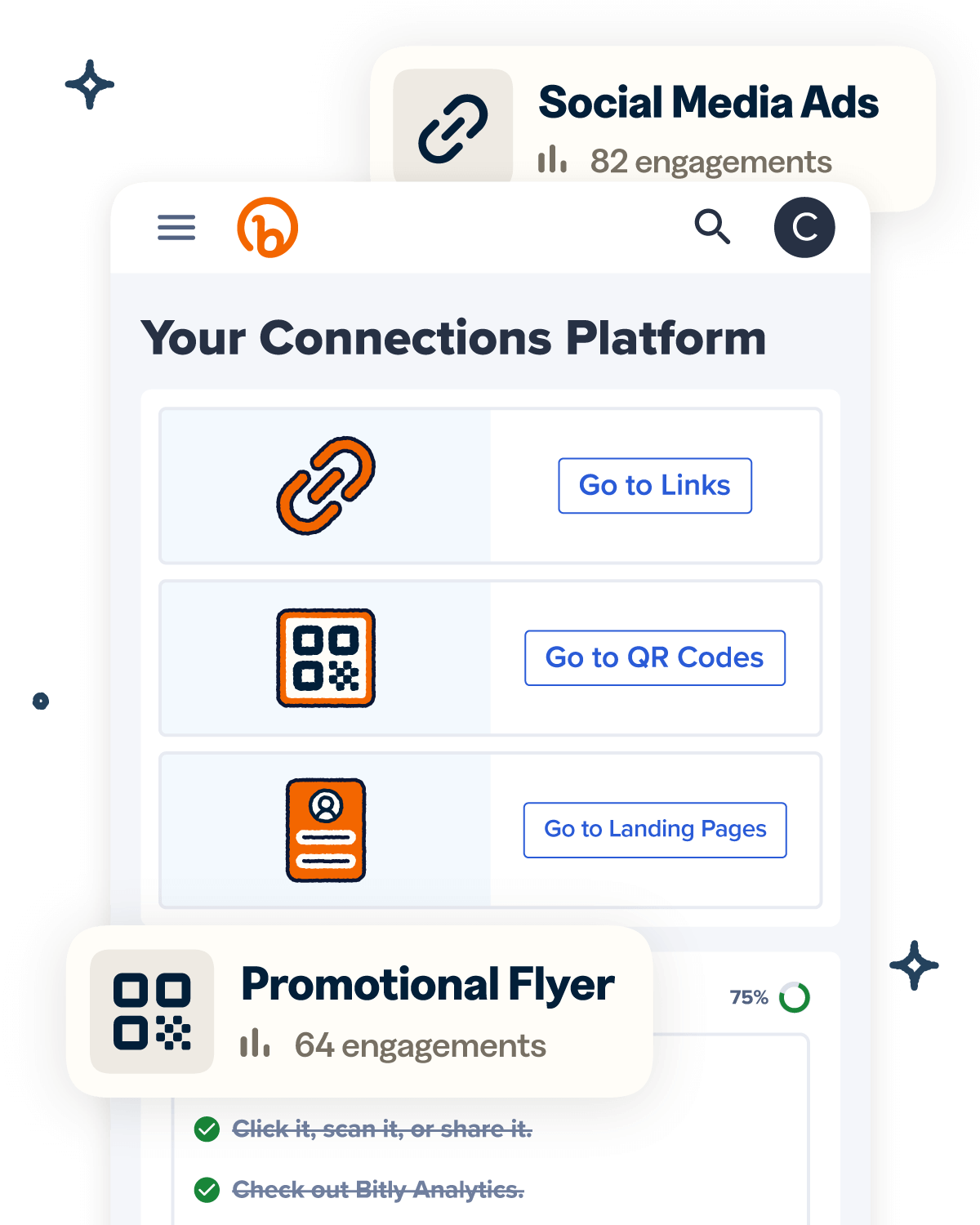

When you use an advanced payment QR Code generator like Bitly, you can customize everything from your code’s patterns to its colors to better align with your brand. You can also add your logo and a call to action (CTA) like “Scan to Tip” to your Bitly Codes to further enhance brand consistency and ensure customers know what to do.

Once you’ve generated your QR Code, add it to your receipts, table tents, kiosks, and other customer touchpoints to encourage more scans.

Add digital tipping to your POS systems

Adding digital tipping to your POS system can streamline customer experiences by allowing them to tip when paying by card during checkout. It’s also incredibly convenient for your business, as it allows you to process tips alongside regular transactions.

Before implementing cashless tipping options through your POS system, confirm if it supports these solutions. If it doesn’t, you’ll need to upgrade to a system that does, such as Kickfin or Clover.

Include tipping prompts during payment to make sure tipping remains top-of-mind for customers during checkout. You can also add preset customizable dollar amounts or percentages to provide a seamless, friction-free experience.

Offer digital tipping through mobile payment apps

Cashless tipping through mobile payment apps like Venmo and PayPal is convenient for customers who are already using them since they don’t need to download additional apps. It’s also more affordable than a POS integration, as it doesn’t require any hardware upgrades.

To accept digital tips through payment apps, first identify the most popular options with your target audience—you can use a QR Code survey for this— and set up business accounts with them. Then generate QR Codes to provide direct access to your chosen cashless tipping platforms for hassle-free transactions.

Add tipping solutions to digital receipts

If you transact online, make the most of the digital receipts you send via email or SMS by including a link that directs customers to your tipping page. This way, they don’t have to search your website for a tipping option.

To implement this strategy, shorten your tipping link so it can fit better within your messages. With Bitly as your URL shortener, you not only get to reduce your URLs’ characters to manageable lengths for easier sharing but also have the option to brand them.

Bitly Links can carry your custom domain name, enhancing customers’ recognition and leading to more engagement. They also provide real-time click data, allowing you to gauge how customers engage with your links and refine your targeting strategy.

Join countless other businesses and consider cashless tipping today

As customers move away from cash-based transactions and embrace the cashless lifestyle, more businesses will likely offer digital tipping solutions to meet customers’ needs.

It’s a convenient option that eliminates the need to carry cash around, which can lead customers to tip more frequently and in larger amounts. It also simplifies payment processing and tip reporting for businesses, making it a valuable solution for improved compliance.

With Bitly QR Codes and short links, you can seamlessly implement cashless tipping options and provide quick access to your tipping page. Plus, both solutions are fully customizable to align with your brand identity, which boosts brand recognition and encourages more customers to tip.

Sign up for Bitly today to offer digital tipping capabilities using reliable QR Codes and short links!